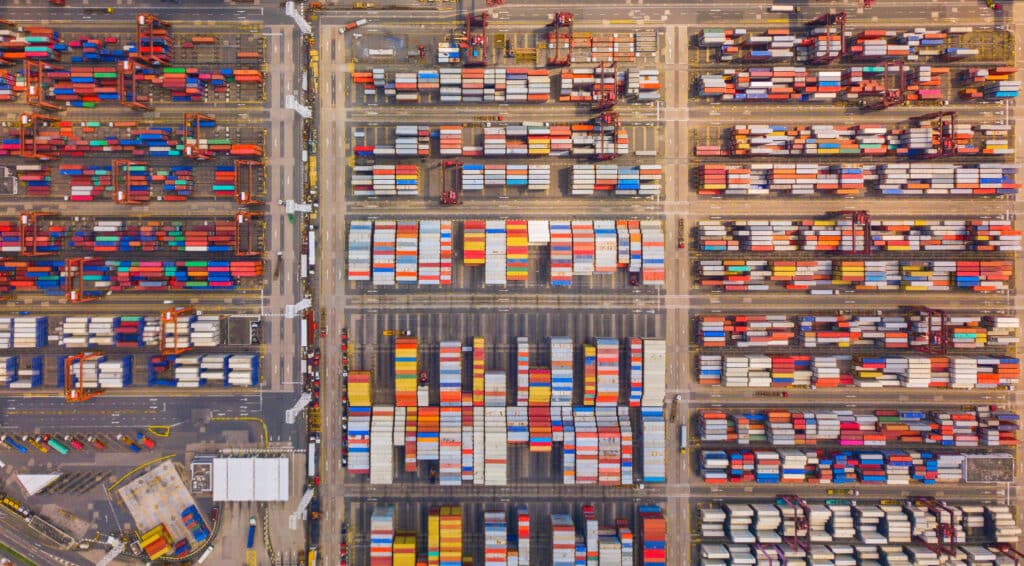

The Canada Border Services Agency’s (CBSA) Assessment and Revenue Management (CARM) initiative is not just transforming Canadian import processes; it’s reshaping the dynamics of international trade. This article delves into the broader implications of CARM on global trade and compliance, offering insights into its integration with international standards and the ensuing effects on both Canadian and global businesses.

Global Trade and CARM

CARM’s implementation signifies a crucial alignment of Canadian import processes with the evolving global trade environment. This harmonization is essential in an era where supply chains are increasingly interlinked and reliant on efficient border management. By digitizing and streamlining procedures, CARM facilitates smoother trade flows, making Canada an even more attractive trade partner on the global stage.

Compliance and Regulatory Changes

A core aspect of CARM is its focus on compliance with international trade regulations. The initiative is designed to ensure that Canadian import practices not only meet but exceed global standards, thereby enhancing the country’s reputation for reliability and regulatory adherence. For Canadian businesses, this translates to a need for heightened awareness and adaptation to these evolving compliance standards.

Impact on Non-Canadian Entities

CARM’s reach extends beyond Canadian borders, impacting foreign traders and businesses engaged with Canadian importers. These entities must acquaint themselves with CARM’s requirements, as their trade activities with Canada will now be governed by this new system. Understanding CARM’s processes and compliance standards is imperative for maintaining smooth trade relations with Canadian counterparts.

As CARM redefines the landscape of Canadian imports, its ripple effects on international trade are becoming increasingly evident. Understanding and adapting to these changes is vital for businesses engaged in global trade, particularly those with ties to Canada. In this new era, staying informed and proactive is key to navigating the complexities of international trade compliance under CARM.

For more information, please visit our CARM page.