Ai Surety Bonding is a specialized full-service brokerage that supports and assists both law offices and their clients with fiduciary surety bonding, estate bonds, and other insurance products.

Whether you are a trustee or a law office, Ai Surety Bonding offers estate bonds for all provinces and international requests, license and permit bonds, customs and excise tax bonds, administration bonds, executor bonds, and much more.

We are available to help you without having to shop around for court, fidelity, commercial, contract and specialty bonds.

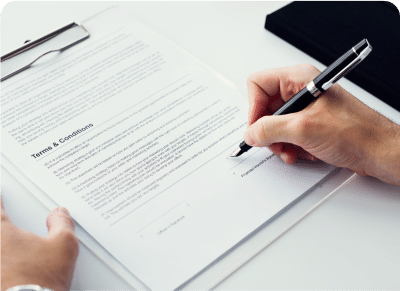

Settling a loved one’s estate can be difficult and complex.

You may find yourself in need of an estate bond if nominated to act as the Executor or Administrator of a family member or friend, in the presence or absence of a will.

Required when no will exists or is missing. An Administration Bond protects the creditors and lawful heirs of the estate.

Guarantees the court that the individual assigned to serve as a guardian will perform their obligations as required by law.

Assures the Executor of an estate correctly allocates the assets with whom they have been assigned fiduciary duty.

Required when the Executor of the Estate resides outside of the provincial or national jurisdiction of the court.

Required to transfer assets in the name of the beneficiary of the estate without a probate letter.

Required when a Public Trustee is designated as Guardian, and a “known” heir of the estate is found.

An Estate Bond, also known as a Fiduciary Bond or Probate Bond, is a guarantee the individual undertaking this endeavour will deliver on their obligations to the courts and to the deceased’s affairs.

Estate bonds, also known as executor bonds and administrator bonds, are a type of court bond required to protect the interests of an estate and its beneficiaries in accordance with applicable laws.

When a person dies, they need to appoint someone to manage the deceased’s affairs until debts and taxes have been paid. Only then are the property and assets of the estate disbursed. Estate bonds guarantee the faithful and honest accounts given by fiduciaries or executors on behalf of an estate. The beneficiaries are ensured that everything is accounted for, without any chance of overlooking something in their favour. The bonds are defensive language that can protect against the evasive actions of an executor or fiduciary. This defense offers protection if the latter persons would make monetary withdrawals from property instead of saving it for someone’s future interest

An estate or probate bond, however, is not insurance. The bonded party would be responsible to the surety for payments it makes on your behalf due to your failure to fulfill your duties toward the estate. An Indemnity Agreement signed when purchasing the bond functions as your promise to repay the surety for the losses you cause the surety to pay on your behalf. Often an appointment as administrator or executor will not be finalized until the estate or probate surety bond is purchased.

That individual is the Principal, and if the principal doesn’t meet the obligations set forth, then the beneficiaries and/or Courts, known as the Obligee, may make a claim. The third-party of an Estate bond is the Surety. This is the company that will be paying up on that guarantee if the principal doesn’t follow through as expected.

The trustee/executor/administrator/ applicant that’s appointed to perform the duties and fulfilling all obligations.

The estate/courts/beneficiaries for whom the administration/execution is being done.

The Company that is making the guarantee on behalf of the principal to the obligee.

An estate bond is required when an individual dies or becomes incapacitated and has not established a will. The probate court must establish which family members are heirs and the court requires that each heir post an estate bond before it can distribute assets to them. An estate bond is a type of financial instrument that guarantees the executor will fulfill all of the obligations they are owed, such as paying estate taxes. It can also protect the heirs if something goes wrong during the probate process. For example, if an executor fails to timely pay property taxes on behalf of someone else’s property, then that person may be liable for them along with any penalties.

An estate bond is required when the value of the estate exceeds the provincial exemption. This means that if an individual’s estate comprises more than that allowable amount, then he or she must acquire an estate bond.

There are many reasons why you may need to obtain an estate bond. Property such as jewelry, fur coats, and artwork may be subject to creditors who could claim ownership of these items in the event of the owner’s death. An estate bond protects these types of assets so they do not become subject to other people’s claims.

If you are a trustee of an estate, it is imperative that you purchase an estate bond to protect the beneficiaries of the estate. Estate bonds are also purchased in case one or more of the beneficiaries sue you in civil court. If one of the beneficiaries files suit against you, they will be required to post a performance bond to ensure payment.

The purpose of an estate bond is to provide a final safety net for the people you care about. When you die, your estate can be tied up in court battles if you don’t have an estate bond in place. Protecting your family with an estate bond gives them peace of mind and time to grieve rather than worry about how they will continue to live when their loved one dies.

An estate bond is a specialized type of insurance policy that covers the beneficiaries who are closest to the deceased. The other beneficiaries, such as children or grandchildren, may not be covered by the estate bond. This type of bond is meant to protect the beneficiaries in case there is any unexpected expense, what would come out of their own pockets for something like funeral costs.

Applying for an estate bond can be confusing and overwhelming. To help you go through the application process, we have created a list of the documentation you may need. The licensed Surety will provide the Applicant/Court with a bond subject to receipt and satisfactory review of the following documentation:

*Other information may be required depending on the estate size and complexity.

Given the size and circumstances of the estate, costs of the estate bonds will vary from surety company to surety company.

Applications and forms can be requested by contacting us here.

In most cases, an Estate bond or Guardianship bond will only be canceled when a court order is submitted to the surety.

*In certain circumstances, the surety will accept a “Release” from the executor(s) and beneficiaries.

Submit/File a final accounting with the court to get the bond released.

In the case of a Guardian bond, the guardian must file the death certificate and a final accounting with the public guardian’s office who will review and release the bond, thus ending the surety obligation.

Estate bonds are sold by Surety companies via their broker partners.

An estate bond’s cost is determined by the amount of coverage it provides, based on a rate (multiplied by the estate value) and term provided by a particular surety, typically in the range of 0.5% – 1%. The higher the bond amount, the higher the cost.

For example, if you have a $500,000.00 estate bond requirement, and the rate proposed is 1% the bond will cost $5000.00.

This is a typically a one-time fee and it’s paid upon issuance of the bond.

With Ai Insurance we will always request a bond company pursues an option for a one-time fee instead of annual fees.

Guardianship bonds are the only estate bond instrument where an annual fee is charged based on an annual rate. The bond will be billed each year it is required, usually up front and renewed at the discretion of the surety outlined in it’s terms of support.

The costs of obtaining estate bonds are the responsibility of the estate and are typically paid for by Trustee/Executor/Administrator before letter of probate are granted, then refunded by the estate along with all other incurred costs.

In any event where a second year term for an estate bond is purchased, in addition to any years after, a pro-rata refund will be provided to the estate. The conditions of the closure and refund will be forwarded with all proposed terms of support.

If you are an estate lawyer and would like to refer your clients, learn more about our program below:

Ai provides value not only to our clients but to our trusted partners in private, public, and legal practices. We are committed to offering our customers and their representation the highest possible standards of service the bonding industry has to offer.

We believe in organically growing our network of business affiliates to assist and provide financial surety to lawyers across Canada and abroad.

Contact us by filling out the form below if your client requires an estate bond, if you have any questions about the estate bonding process, or if you would like to become a centre of influence for your clients.